Politics

Beyond Numbers: How Financial Dashboards Tell theStory of Your Chamaa

Once upon a past, a group of friends decided to pool their resources, embarking on a shared journey towards financial freedom. But as their Chamaa grew, so did the chaos – missed contributions, forgotten meetings, endless paperwork. Then, like a hero in a modern-day fairy tale, RoundCircle emerged. With its magical touch of automation, it transformed their Chamaa into a seamless, stress-free adventure. Contributions flowed effortlessly, meetings were a breeze, and every member had a crystal-clear view of their progress. Now, you too can be part of this enchanting story. Let RoundCircle guide your Chamaa to new heights, turning your hard earned treasure into legacy with just a few clicks.

Read MoreFrom member settings to loan management, and contribution allocation, RoundCircle has it all covered. Once everything is set up and ready for use, you can sit back and relax as our smart systems handle the mundane monthly workflows for you. Imagine this: A member pays more than required—our intelligent system automatically allocates the excess to the next month’s contributions. No more manual interventions, just smooth sailing.

Read MoreStep into the driver's seat and become the master of your Chamaas with RoundCircle! Imagine juggling multiple Chamaas without breaking a sweat. Our combined dashboard puts you at the center of control, allowing you to measure performance and get key insights on KPIs for each of your Chamaas, all from one account. Whether you're managing one group or a dozen, RoundCircle makes it a breeze. No kugeria mani (no fumbling around) – just pure, effortless control. Join us and turn your financial juggling act into a smooth, easy ride!

Read MoreWho we are

In a world where community and collaboration reign supreme, RoundCircle was born from a simple yet powerful idea: to make Chamaa management as effortless as possible. We are a team of diverse professionals, each bringing a unique skill set to the table, united by a common goal.

Our journey began with a passion for innovation and a vision for seamless financial management. We set out to create a platform that blends tradition with technology, allowing you to focus on what truly matters – achieving your financial goals together.

From tech enthusiasts to financial experts, our team is dedicated to transforming the way Chamaas operate. We believe in the power of collective dreams and the magic of making them come true with ease and efficiency.

Read MoreOversee and Synchronize Member Contributions, Ensuring Real-Time Accuracy and Simplified Financial Coordination for Your Chamaa.

Be financial savvy with our seamless integration of features that not only enhances financial management but also fosters a more engaged and proactive community within each Chamaa. Experience the convenience and peace of mind that comes with RoundCircle's innovative approach to managing Chamaa finances.

Stay updated with real-time investment insights, access detailed performance reports, and utilize risk management tools to make informed decisions. Receive timely alerts about market changes and tailor investment strategies to fit your Chamaa’s goals. RoundCircle’s comprehensive tracking ensures data-driven, proactive financial planning for sustainable growth.

By tailoring investment plans to fit your Chamaa's unique goals and risk appetite, RoundCircle ensures that every decision is data-driven and aligned with your overall financial objectives. The collaborative decision-making feature fosters informed discussions among members, enhancing collective investment strategies and promoting sustainable growth.

Easily manage loan applications, approvals, and repayments through personalized member portals. RoundCircle’s system ensures accuracy and transparency by automating every step, from application submission to repayment tracking. Members can monitor their loan status in real-time, and Chamaa admins can approve requests seamlessly, reducing manual work and improving efficiency. Experience hassle-free loan management with RoundCircle’s intuitive and comprehensive solution.

Enhance your Chamaa’s loan operations with a dynamic automated workflow that not only fits your internal processes but streamlines them. Manage loan applications, approvals, and repayments effortlessly, ensuring accuracy and transparency at every step.

Experience comprehensive management with RoundCircle's unified dashboard. Oversee all Chamaa operations from a single, intuitive interface. Monitor financial activities in real-time, including contributions, loans, and investments, ensuring streamlined operations, improved decision-making, and enhanced transparency.

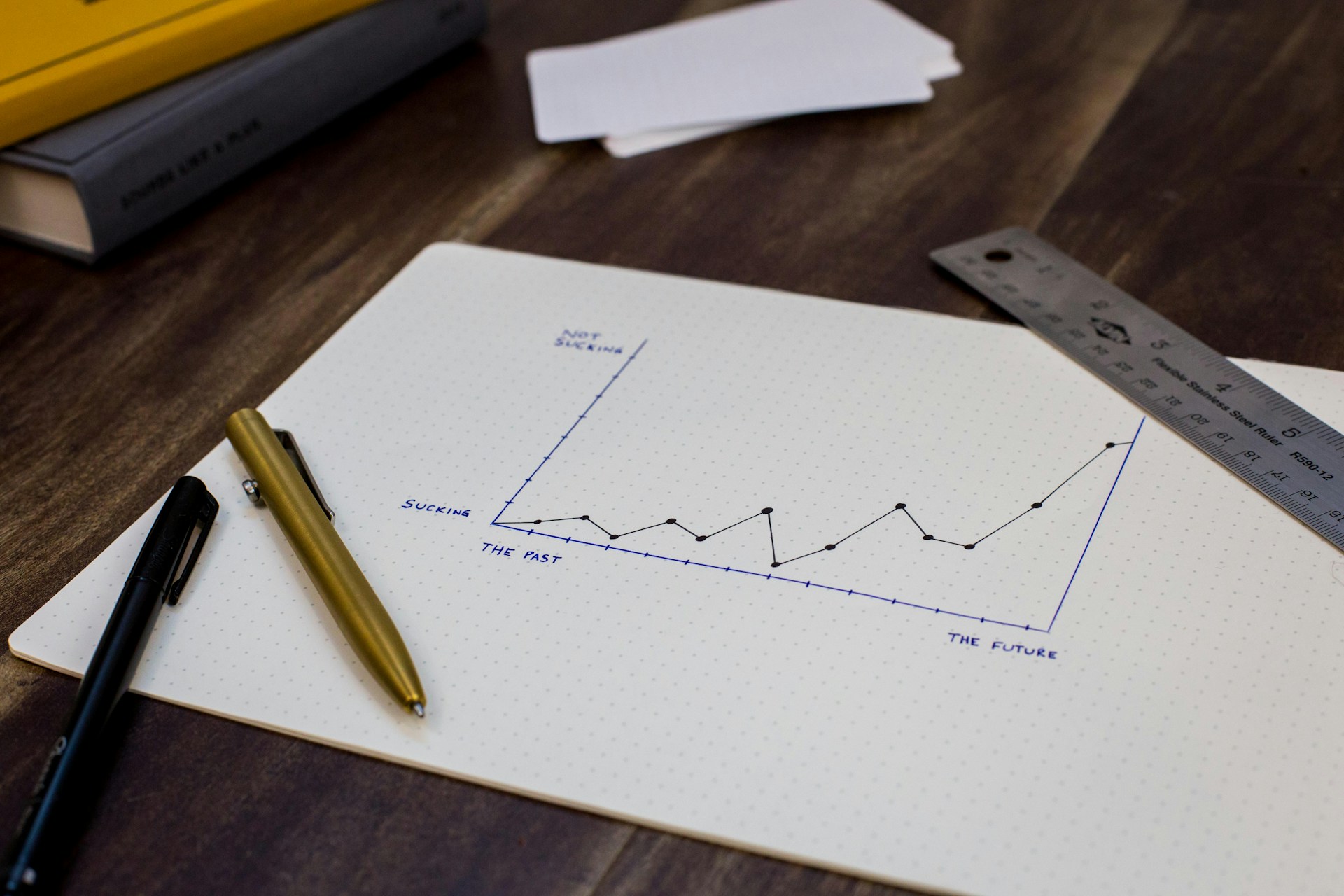

Dashboards are the heart of RoundCircle's financial management system, allowing you to customize what is important to you and your Chamaa. With personalized and prioritized views, the most critical and impactful information is always front and center. This enhances decision-making and operational efficiency, making financial management more intuitive and effective.

Leave behind the stress of manual financial management and step into a world where you can truly focus on what matters—growing your wealth and living your best life. RoundCircle brings you the joy of effortless contributions, savvy investments, and seamless loan management. With our system, you’re not just managing finances; you're building a future of prosperity and peace of mind. Let RoundCircle take care of the details, so you can enjoy the freedom and success you deserve.

What we do offer

Members can log in to monitor contributions, set reminders, choose payment modes, manage guarantors, and handle loans effortlessly.

Members set up contribution schedules, automated with smart reminders, notifications, and M-Pesa integrations, ensuring consistent and timely contributions.

Automated fines ensure accountability by applying penalties for missed contributions, encouraging timely and consistent member payments.

Generate personalized financial reports for each member, showcasing detailed insights into their contributions, loans, financial health, and areas for improvement.

Streamline the process of winding down accounts, transferring Chamaa assets, and reallocating resources efficiently with ease.

Ensure all financial operations follow your Chamaa's organizational mandate by applying necessary authorizations for added security and compliance.

Maximize growth while reducing costs

Frequently Asked Questions

Recent Blog Posts

Contact Us

PO Box 23007-00604, Lower Kabete, Kenya

+254 700 xxx xxx

info@roundcircle.com